etx capital binary options demo

London based ETX Uppercase stand for one of the 'new brood' of binary operators. Primarily a spread betting and CFD (Contracts for Divergence) brokers, they accept added binary options to their portfolio. They provide an excellent trading platform and due to them providing CFD trading in the United kingdom of great britain and northern ireland, are fully regulated by the Fiscal Acquit Authority (FCA)Number 124721. While binary options are yet to fall under the authorisation of the FCA, it is proficient to know the firm themselves comply due to the CFD element of the concern.

Here is how ETX view themselves; "We believe that ETX Capital offers traders a broad diversity of benefits that many of our competitors may find hard to friction match."

Key info for ETX Capital letter

- Minimum Deposit – £200

- Minimum trade – £ten

- Demo Account – Yes

- Signals service – No.

- Mobile App – Yes. Compatible across android, iOS (iPhone and iPad) and windows devices.

Trading Platform

ETX operate a specific Binary platform, with it's own login. The first thing of note is that information technology is closed entirely while global markets are closed – there are no "randoms" or other virtual markets to entice clients to over trade.

ETX Capital letter also offer CFDs and Forex trading, those platforms are covers in more than item in DayTrading.com'southward ETX Review.

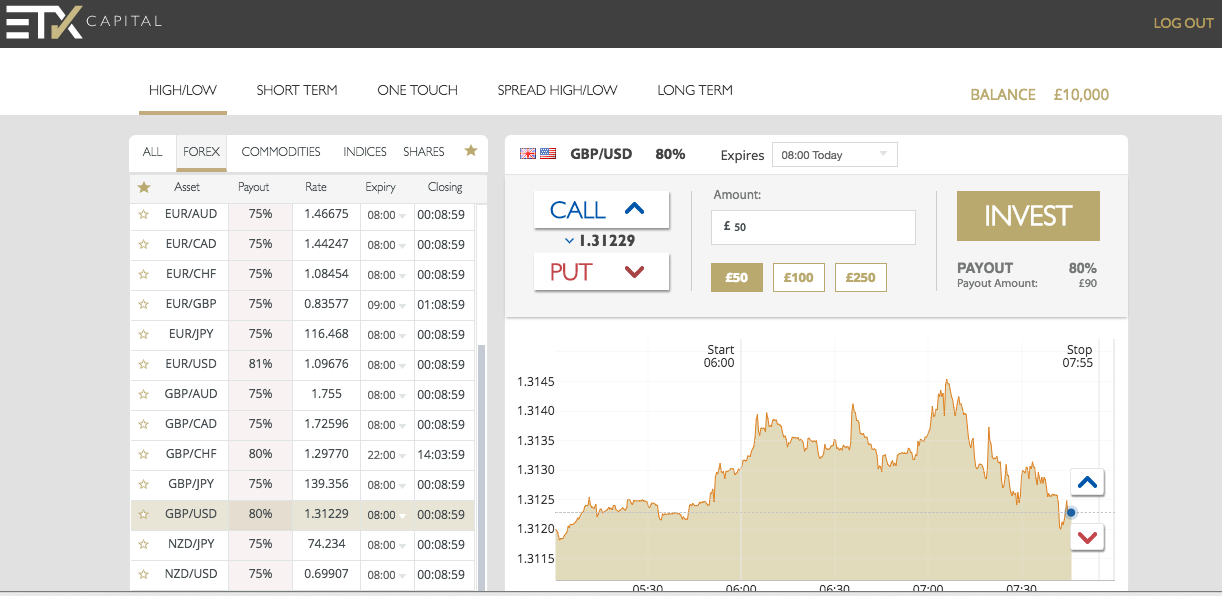

The left hand side of the trading platform is the asset and options listing. ETX provide the usual mix of assets – Forex, Indices, Commodities and Stock. The lists are all-encompassing, with all major FX pairs covered. On certain option types ('Long term' for instance), the asset lists will shorten as not all markets are available across all choice types.

Once the option and nugget take been selected, the price graph volition update on the correct of the screen. From here, the expiry tin can be adjusted too, with incremental expiries available, plus 'end-of-day' expiry times. The stake level is to a higher place the price graph, with preset buttons available to quicken the trading process.

The Call and Put buttons are clear, with the strike cost illustrated between the buttons. One time highlighted, trader simply click on 'Invest' to confirm the trade. Once open up, a trade will appear in the 'Open Positions' screen below the trading platform. The price graph will as well show the current status of the merchandise, with either a bluish (in the money) box or a carmine (out of the money) box highlighting the electric current direction of the trade.

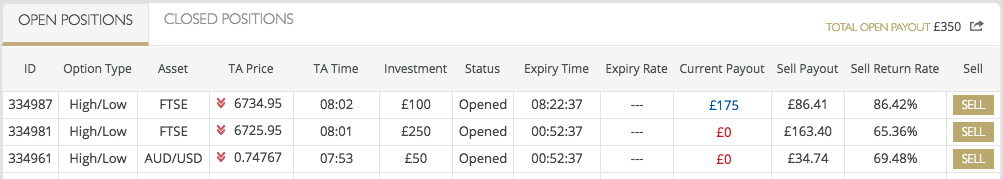

In the Open up positions window, traders are offered a 'Sell' value for their trades. This can be used to cash in profitable positions, or to reduce loses on trades which have moved against the merchandise. Traders can login at any time to view their current positions and sell them if they desire to.

In the Open up positions window, traders are offered a 'Sell' value for their trades. This can be used to cash in profitable positions, or to reduce loses on trades which have moved against the merchandise. Traders can login at any time to view their current positions and sell them if they desire to.

Trader pick

As well as more than traditional options, ETX Capital besides offer the 'Spread Loftier/Low' which at present, is unique to them;

- High/Depression – The traditional binary – will the asset price be higher or lower than the electric current strike toll at expiry?

- Curt Term – The same concept as High/Low but these options have very short death times. At ETX, they are more often than not lx second or ii minute expiries.

- One Impact – ETX provide both high and depression 'touch' prices. These terminate 'in the money' immediately if the toll level is reached or surpassed. The is no 'No bear on' option however. Volatility therefore plays a key role.

- Spread High/Low – Unique to ETX Capital, these options take strike prices slightly above, or beneath the bodily current price level. Across that, they behave just equally a standard High/Low option. The difference is that the payout on the spread option is 100% – ETX tin can do this because their "spread" is covered by moving the strike toll. It is a nice innovation, which some traders will enjoy.

- Long Term – Once again, the trades behave equally a standard High/Low, but these accept longer decease times. At ETX, these are generally the end of the month (the terminate of the concluding trading session of the agenda month).

The range of assets is fantabulous and the pick types are adept – some additional expiry times inside the long term range, and maybe adding Ladder or purlieus options, would mean ETX compete with the very best for trading selection.

ETX Capital Mobile App

The mobile app has been separated from the CFD trading app, to focus purely on binaries. Available on Android (v3.0.0 and upward) and iOS, the application delivers the same await and feel as the website, and all of the functionality. All assets and merchandise types are on offering from the mobile platform, every bit are merchandise history and account management features.

The mobile app is bachelor gratis to all ETX customers. The download is quick and simple, and traders can login and trade quickly.

Payout

Payouts at ETX can reach 100%. This is due to the 'Spread High/Depression' option, where the turn a profit margin of the broker is built into the strike price "spread". They tin therefore afford to pay 100% on in the money trades. Elsewhere, payout are generally 75% or fourscore% – where assets are more popular, the payouts tend to exist higher. The levels are certainly very competitive. Payouts volition always vary based on the nugget and expiry time, but ETX certainly tend to exist at the college level in comparison with rivals, and the 'Spread Loftier/Low' trades requite them an eye-catching headline payout.

ETX Spreads

ETX offer some very tight spreads. For instance, just 0.nine on EUR/USD and GBP/USD. Forex spreads are a item strength, simply ETX are competitive across the board.

Withdrawal and Eolith Options

Equally a broker that is regulated by the FCA, ETX Capital have strict controls on eolith and withdrawal methods, and this in turn, ensures greater protection for the trader and their funds.

In that location is a £100minimum deposit requirement at ETX, though you must have sufficient funds in your business relationship to open trades. The amount required volition depend on the asset, and decease.

Deposits tin can be made via debit or credit card but these must be in the proper noun of the individual (not a commercial card for example).Wire depository financial institution transfers are accepted, once more they must be in the aforementioned name as the individual on the trading business relationship. Deposits tin be made via exactly the same options over the mobile apps. ETX accept deposits in a broad range of currencies, including GBP, USD, EUR, ZAR, SGD, SEK, RON, PLN, NOK, JPY, HRK, HKD, DKK, CZK, CHF, CAD, AUD.

Withdrawals are a positive at ETX. Depository financial institution transfers should be process in 2 or 3 days – withdrawals to a debit or credit card will take a day longer. There no fees for withdrawals – unless traders brand of 5 requests in a single month. Any withdrawals over 5 within a calendar month volition incur a £ten charge.

There is as well a £15 charge per month for 'dormant' accounts. An business relationship is deemed dormant if there are funds in information technology, simply no trades have been placed over 120 days.

Other Features

ETX offer a broad range of additional benefits:

- MT4 Platform – A peachy platform for advanced traders and technical analysis investors. Seamless integration on this popular platform.

- Huge Range Of Markets

- Tight Spreads – ETX offering some very competitive spreads compared to rival CFD and Forex brokers.

- Training Materials – Including webinars, which are very pop among users, and very helpful.

- Excellent Reputation – ETX generate very few complaints, and savour loftier satisfaction ratings from their user base.

Source: https://www.binaryoptions.co.uk/etx-capital

Posted by: flemingpringdow.blogspot.com

0 Response to "etx capital binary options demo"

Post a Comment