using bollinger bands for binary options

Chasing after momentum moves college or lower tin can be a challenging trading strategy, peculiarly during volatile market conditions after big news events. However, helpful tools like Bollinger bands can be particularly useful as they assist to sympathize how Volatility Volatility In finance, volatility refers to the amount of change in the rate of a financial instrument, such as commodities, currencies, stocks, over a given time period. Substantially, volatility describes the nature of an instrument'due south fluctuation; a highly volatile security equates to large fluctuations in price, and a low volatile security equates to timid fluctuations in price. Volatility is an important statistical indicator used by fiscal traders to assist them in developing trading systems. Traders can be successful in both low and loftier volatile environments, just the strategies employed are often dissimilar depending upon volatility. Why Too Much Volatility is a ProblemIn the FX space, lower volatile currency pairs offer less surprises, and are suited to position traders.High volatile pairs are attractive for many day traders, due to quick and stiff movements, offering the potential for college profits, although the take a chance associated with such volatile pairs are many. Overall, a look at previous volatility tells usa how likely toll will fluctuate in the future, although information technology has nil to do with management.All a trader tin can assemble from this is the understanding that the probability of a volatile pair to increase or decrease an X corporeality in a Y menstruum of time, is more the probability of a non-volatile pair. Another important gene is, volatility can and does modify over time, and there can be periods when even highly volatile instruments show signs of flatness, with price non really making headway in either direction. As well footling volatility is just as problematic for markets every bit too much, we uncertainty in excess can create panic and problems of liquidity. This was evident during Black Swan events or other crisis that have historically roiled currency and disinterestedness markets. In finance, volatility refers to the amount of change in the charge per unit of a financial musical instrument, such every bit commodities, currencies, stocks, over a given fourth dimension menses. Essentially, volatility describes the nature of an instrument's fluctuation; a highly volatile security equates to large fluctuations in price, and a low volatile security equates to timid fluctuations in price. Volatility is an of import statistical indicator used by fiscal traders to assist them in developing trading systems. Traders tin can be successful in both low and loftier volatile environments, merely the strategies employed are often unlike depending upon volatility. Why Likewise Much Volatility is a ProblemIn the FX infinite, lower volatile currency pairs offer less surprises, and are suited to position traders.High volatile pairs are attractive for many day traders, due to quick and strong movements, offering the potential for higher profits, although the chance associated with such volatile pairs are many. Overall, a expect at previous volatility tells us how likely price volition fluctuate in the future, although it has nothing to practise with management.All a trader tin gather from this is the understanding that the probability of a volatile pair to increase or decrease an X amount in a Y flow of time, is more than the probability of a non-volatile pair. Another important factor is, volatility can and does change over time, and there can be periods when even highly volatile instruments bear witness signs of flatness, with price not actually making headway in either direction. Too little volatility is merely every bit problematic for markets as as well much, we uncertainty in excess can create panic and problems of liquidity. This was axiomatic during Black Swan events or other crisis that have historically roiled currency and equity markets. Read this Term is changing and furthermore when momentum is overextended to one direction or another.

Bollinger bands are extremely beneficial when it comes to trading pullbacks in momentum.

Bollinger bands are extremely beneficial when information technology comes to trading pullbacks in momentum or fifty-fifty trend reversals by helping spot a trading asset that is either overbought or oversold.

Setting Bollinger Bands

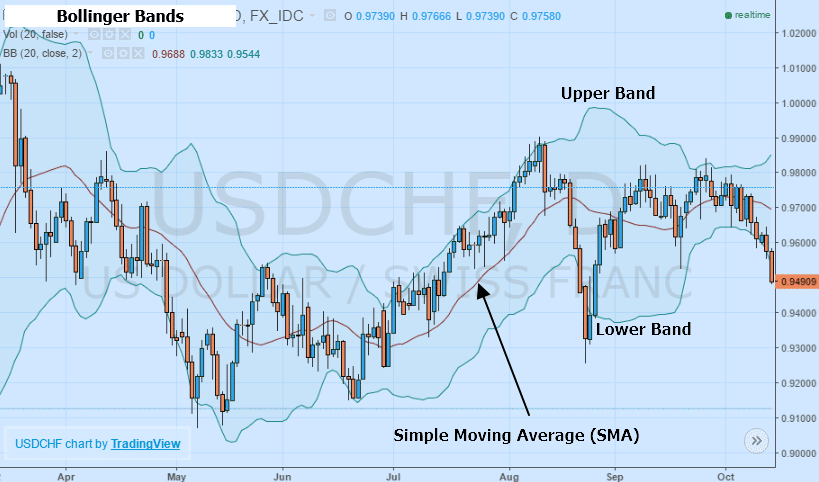

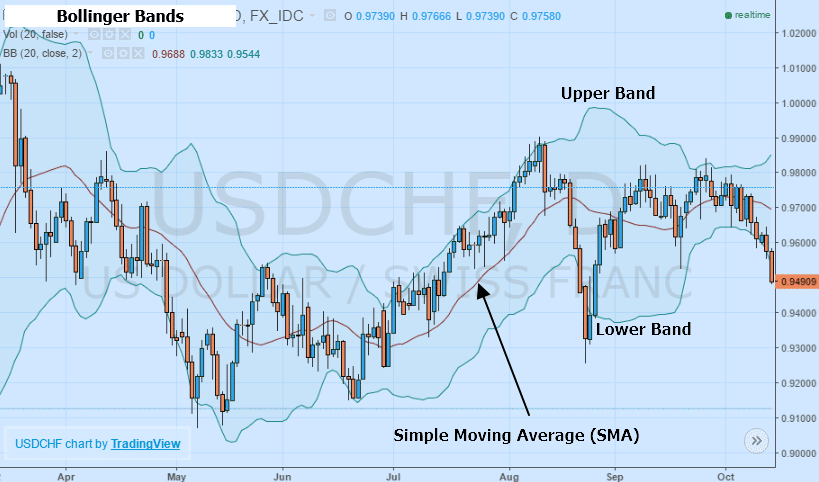

Named after inventor and famed technical trader, Jon Bollinger, this technical indicator calculates the distance of price from a elementary moving average that closely tracks the price action in the trading asset.

Using a simple moving average which can be set to any number of periods, Bollinger bands are set up both above and below the moving boilerplate to a distance that depends on the volatility based on earlier changes in prices.

Mathematically, the altitude of each Bollinger band from the simple moving boilerplate is typically prepare at two standard deviations of an average of before price volatility.

The math there tells us that depression volatility weather condition will be indicated by narrower Bollinger bands while highly volatile conditions will upshot in wider bands. This means that when prices of an asset to either touch or cross a Bollinger band, information technology must be an extreme directional motility that based on the higher or lower ring could signal atmospheric condition in which said asset is overbought or oversold.

The simple moving boilerplate is typically designed to mensurate 21 periods when used classically alongside bands fix at two standard deviations. However, depending on your trading time horizon, these inputs might desire to be adjusted to fit a sure trading mode and strategy.

Bollinger bands tin can be instrumental in correctly setting the potential take a chance and reward parameters for a merchandise.

Bollinger bands are more than simply helpful for identifying weather condition in which an asset is overbought or oversold, they can be instrumental in correctly setting the potential risk and advantage parameters for a merchandise.

Some traders wait for volatility to narrow sharply, indicated by Bollinger bands that are closely hugging the simple moving boilerplate to help spot out breakouts in momentum. These breakouts normally result afterward an instrument has been trending in a narrow range for an extended period of fourth dimension.

Pop Bollinger Ring Patterns To Trade

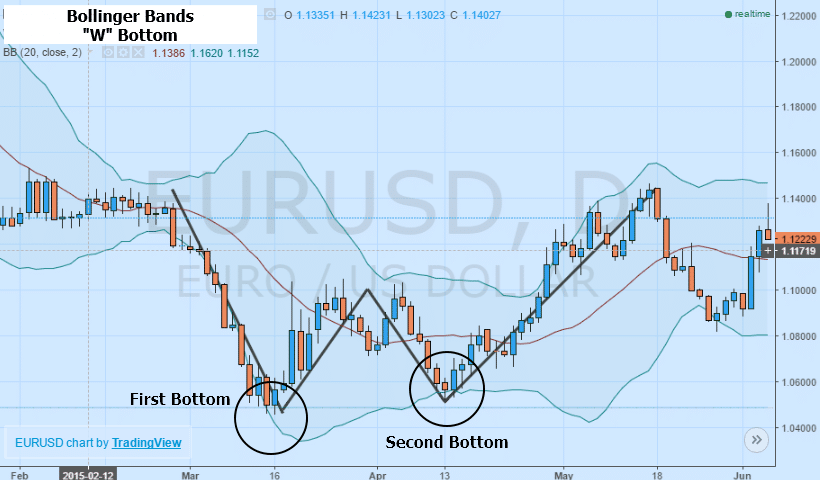

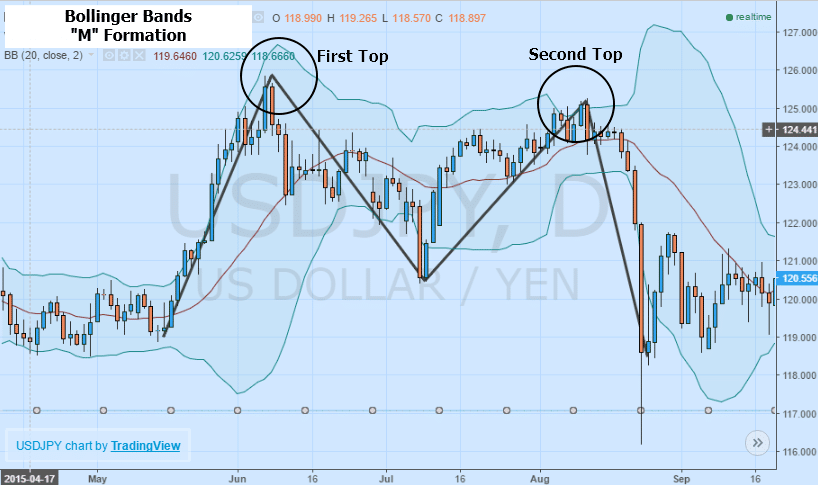

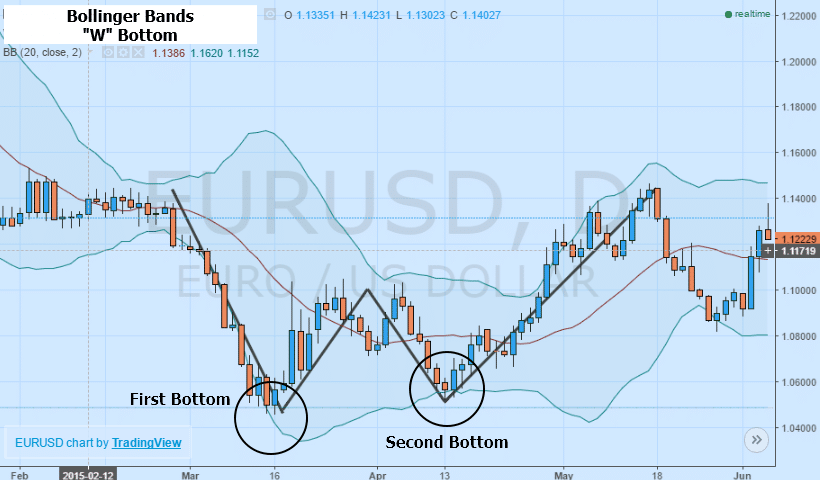

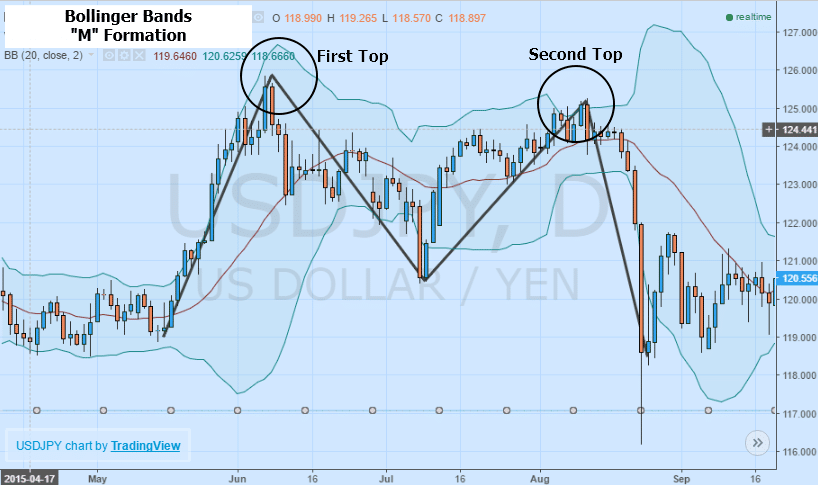

Ane of the nearly popular patterns that traders like to use with Bollinger bands is the identification of "One thousand" tops and "W" bottoms in the toll action. Typically viewed as a potent reversal signal like to double bottoms and tops, the Bollinger bands can be useful in identifying potential entry points for trades and even breakout opportunities.

A bullish bottom blueprint is formed by 2 successive bottoms in price activeness which typically resembles a "West", although at outset it will resemble an upside down "North". The key lies in establishing bullish positions nearly the lower Bollinger band with a target set on the upper Bollinger bands. However, if prices keep to fall, information technology may be a stiff sign to leave and search for a new opportunity.

A bearish acme design is formed past two successive tops in price which contrary to the "W" form a "M". Before forming the entire "M" an "North" volition emerge in the price activeness and this is the signal at which traders should desire to get involved.

When at the second superlative and the "N" has been formed by the nugget cost action, it is fourth dimension to establish a bearish position in the trading asset. Should prices continue to ascension subsequently the fact and move higher above the 2nd top it is a signal to leave and await for new opportunities to ascend.

To wrap it upward, let's take a look at this summary:

Some Notes

First, While Bollinger bands are exceptionally helpful in determining when an asset has overshot to the upside or downside, it is important to use the bands to likewise set risk weather, non just entry points.

Additionally, risk and advantage should be fix based on the width of the bands, or volatility, with narrower take chances-reward during low volatility and wider risk-reward during higher volatility.

Idan is the VP trading for anyoption.com. He is a seasoned professional with years of experience trading and has a vast knowledge of the financial markets. An good in the binary options hedging field – Idan provides insights, guidance and coordination in business organisation planning, Run a risk Management Run a risk Direction One of the most common terms utilized by brokers, adventure management refers to the practice of identifying potential risks in advance. Virtually commonly, this also involves the analysis of risk and the undertaking of precautionary steps to both mitigate and prevent for such risk.Such efforts are essential for brokers and venues in the finance industry, given the potential for fallout in the face of unforeseen events or crises. Given a more tightly regulated environment across almost every nugget class, near brokers use a risk management section tasked with analyzing the data and menses of the broker to mitigate the business firm'south exposure to financial markets moves. Why Risk Management is a Fixture Among BrokersTraditionally the visitor is employing a risk management team that is monitoring the exposure of the brokerage and the performance of select clients which information technology deems risky for the business. Common financial risks also come in the class of high inflation, volatility across capital markets, recession, defalcation, and others.As a countermeasure to these bug, brokers accept looked to minimize and control the exposure of investment to such risks.In the modern hybrid manner of operation, brokers are sending out the flows from the most assisting clients to liquidity providers and internalize the flows from customers.This is accounted less risky and are likely to incur losses on their positions.This in plough allowing the broker to increase its acquirement capture. Several software solutions exist to assistance brokers to manage risk more efficiently and every bit of 2018, virtually connectivity/span providers are integrating a gamble-management module into their offerings. This aspect of running a brokerage is too one of the almost crucial ones when it comes to employing the right kind of talent. I of the about common terms utilized by brokers, risk management refers to the practice of identifying potential risks in advance. Nigh normally, this also involves the analysis of gamble and the undertaking of precautionary steps to both mitigate and foreclose for such risk.Such efforts are essential for brokers and venues in the finance industry, given the potential for fallout in the face up of unforeseen events or crises. Given a more tightly regulated environment across near every nugget course, most brokers employ a risk management department tasked with analyzing the information and menses of the broker to mitigate the firm's exposure to fiscal markets moves. Why Risk Management is a Fixture Among BrokersTraditionally the company is employing a hazard management squad that is monitoring the exposure of the brokerage and the performance of select clients which it deems risky for the business. Common financial risks also come in the class of loftier inflation, volatility beyond capital markets, recession, bankruptcy, and others.As a countermeasure to these issues, brokers have looked to minimize and control the exposure of investment to such risks.In the modern hybrid mode of operation, brokers are sending out the flows from the virtually profitable clients to liquidity providers and internalize the flows from customers.This is deemed less risky and are likely to incur losses on their positions.This in plow allowing the banker to increment its revenue capture. Several software solutions exist to assist brokers to manage hazard more than efficiently and as of 2018, most connectivity/bridge providers are integrating a risk-management module into their offerings. This aspect of running a brokerage is besides one of the well-nigh crucial ones when it comes to employing the right kind of talent. Read this Term and applied science strategies. He holds a BA in Economics Management and is now busy finishing his MBA in Finance.

Chasing later on momentum moves higher or lower can be a challenging trading strategy, especially during volatile market weather afterwards large news events. However, helpful tools like Bollinger bands can be particularly useful as they help to understand how Volatility Volatility In finance, volatility refers to the amount of alter in the rate of a financial instrument, such as commodities, currencies, stocks, over a given time flow. Substantially, volatility describes the nature of an instrument'south fluctuation; a highly volatile security equates to large fluctuations in price, and a low volatile security equates to timid fluctuations in price. Volatility is an important statistical indicator used by financial traders to assist them in developing trading systems. Traders can be successful in both low and high volatile environments, but the strategies employed are oftentimes unlike depending upon volatility. Why Too Much Volatility is a ProblemIn the FX space, lower volatile currency pairs offer less surprises, and are suited to position traders.High volatile pairs are attractive for many 24-hour interval traders, due to quick and strong movements, offering the potential for higher profits, although the risk associated with such volatile pairs are many. Overall, a look at previous volatility tells us how likely price will fluctuate in the future, although it has nothing to do with direction.All a trader can gather from this is the understanding that the probability of a volatile pair to increment or subtract an X amount in a Y menstruum of time, is more than the probability of a non-volatile pair. Another important factor is, volatility can and does change over fourth dimension, and at that place can be periods when fifty-fifty highly volatile instruments bear witness signs of flatness, with toll not really making headway in either direction. Likewise petty volatility is but as problematic for markets as too much, we uncertainty in excess can create panic and bug of liquidity. This was evident during Black Swan events or other crisis that have historically roiled currency and equity markets. In finance, volatility refers to the amount of change in the rate of a fiscal musical instrument, such equally bolt, currencies, stocks, over a given time flow. Essentially, volatility describes the nature of an musical instrument's fluctuation; a highly volatile security equates to large fluctuations in price, and a low volatile security equates to timid fluctuations in cost. Volatility is an important statistical indicator used by fiscal traders to assist them in developing trading systems. Traders can be successful in both depression and high volatile environments, but the strategies employed are frequently dissimilar depending upon volatility. Why Too Much Volatility is a ProblemIn the FX space, lower volatile currency pairs offer less surprises, and are suited to position traders.High volatile pairs are attractive for many day traders, due to quick and strong movements, offering the potential for higher profits, although the risk associated with such volatile pairs are many. Overall, a expect at previous volatility tells us how likely cost will fluctuate in the future, although information technology has nothing to practise with direction.All a trader can gather from this is the understanding that the probability of a volatile pair to increment or decrease an X amount in a Y menstruum of time, is more the probability of a non-volatile pair. Some other important factor is, volatility can and does change over time, and at that place can be periods when even highly volatile instruments testify signs of flatness, with cost non really making headway in either management. Too little volatility is but as problematic for markets as too much, nosotros uncertainty in excess tin can create panic and problems of liquidity. This was evident during Black Swan events or other crisis that accept historically roiled currency and equity markets. Read this Term is changing and furthermore when momentum is overextended to one direction or another.

Bollinger bands are extremely beneficial when it comes to trading pullbacks in momentum.

Bollinger bands are extremely beneficial when information technology comes to trading pullbacks in momentum or even trend reversals by helping spot a trading asset that is either overbought or oversold.

Setting Bollinger Bands

Named after inventor and famed technical trader, Jon Bollinger, this technical indicator calculates the distance of price from a simple moving average that closely tracks the price action in the trading nugget.

Using a unproblematic moving boilerplate which can be gear up to whatever number of periods, Bollinger bands are set up both above and beneath the moving average to a distance that depends on the volatility based on earlier changes in prices.

Mathematically, the distance of each Bollinger band from the unproblematic moving boilerplate is typically set at two standard deviations of an boilerplate of earlier price volatility.

The math there tells u.s.a. that low volatility conditions volition be indicated by narrower Bollinger bands while highly volatile atmospheric condition will result in wider bands. This means that when prices of an nugget to either touch on or cross a Bollinger ring, it must be an extreme directional move that based on the higher or lower band could point weather in which said asset is overbought or oversold.

The simple moving average is typically designed to measure 21 periods when used classically alongside bands fix at two standard deviations. Nonetheless, depending on your trading fourth dimension horizon, these inputs might desire to be adapted to fit a certain trading mode and strategy.

Bollinger bands can be instrumental in correctly setting the potential gamble and reward parameters for a trade.

Bollinger bands are more than than just helpful for identifying atmospheric condition in which an asset is overbought or oversold, they tin exist instrumental in correctly setting the potential chance and reward parameters for a trade.

Some traders wait for volatility to narrow sharply, indicated by Bollinger bands that are closely hugging the unproblematic moving boilerplate to help spot out breakouts in momentum. These breakouts unremarkably result after an instrument has been trending in a narrow range for an extended period of fourth dimension.

Pop Bollinger Band Patterns To Trade

One of the most popular patterns that traders like to use with Bollinger bands is the identification of "M" tops and "Due west" bottoms in the price action. Typically viewed as a strong reversal signal similar to double bottoms and tops, the Bollinger bands tin can be useful in identifying potential entry points for trades and even breakout opportunities.

A bullish bottom blueprint is formed by two successive bottoms in price action which typically resembles a "Westward", although at first it will resemble an upside downward "N". The key lies in establishing bullish positions near the lower Bollinger ring with a target set up on the upper Bollinger bands. However, if prices continue to fall, information technology may be a stiff sign to exit and search for a new opportunity.

A surly tiptop pattern is formed by ii successive tops in price which opposite to the "Due west" form a "Thousand". Before forming the unabridged "M" an "N" will emerge in the price activity and this is the point at which traders should desire to get involved.

When at the 2d pinnacle and the "N" has been formed by the nugget toll activity, it is time to establish a bearish position in the trading asset. Should prices continue to rising after the fact and move higher to a higher place the second top it is a point to go out and wait for new opportunities to arise.

To wrap information technology upwards, let's accept a look at this summary:

Some Notes

First, While Bollinger bands are exceptionally helpful in determining when an asset has overshot to the upside or downside, information technology is important to use the bands to also fix run a risk conditions, not just entry points.

Additionally, risk and reward should be set up based on the width of the bands, or volatility, with narrower risk-reward during depression volatility and wider chance-reward during higher volatility.

Idan is the VP trading for anyoption.com. He is a seasoned professional with years of feel trading and has a vast knowledge of the fiscal markets. An proficient in the binary options hedging field – Idan provides insights, guidance and coordination in business organization planning, Take a chance Management Gamble Management One of the near common terms utilized by brokers, risk management refers to the practice of identifying potential risks in accelerate. Most commonly, this as well involves the analysis of chance and the undertaking of precautionary steps to both mitigate and foreclose for such take chances.Such efforts are essential for brokers and venues in the finance manufacture, given the potential for fallout in the face of unforeseen events or crises. Given a more tightly regulated environment beyond almost every asset class, virtually brokers employ a gamble management department tasked with analyzing the data and catamenia of the broker to mitigate the house's exposure to fiscal markets moves. Why Chance Management is a Fixture Amid BrokersTraditionally the visitor is employing a risk direction squad that is monitoring the exposure of the brokerage and the performance of select clients which information technology deems risky for the business organisation. Mutual financial risks also come in the class of high inflation, volatility beyond capital markets, recession, bankruptcy, and others.Every bit a countermeasure to these issues, brokers have looked to minimize and command the exposure of investment to such risks.In the modern hybrid mode of operation, brokers are sending out the flows from the most profitable clients to liquidity providers and internalize the flows from customers.This is accounted less risky and are likely to incur losses on their positions.This in plough allowing the broker to increase its acquirement capture. Several software solutions be to assist brokers to manage risk more than efficiently and as of 2018, most connectivity/bridge providers are integrating a take a chance-direction module into their offerings. This aspect of running a brokerage is too i of the most crucial ones when it comes to employing the right kind of talent. Ane of the most common terms utilized past brokers, risk direction refers to the do of identifying potential risks in accelerate. About unremarkably, this also involves the analysis of risk and the undertaking of precautionary steps to both mitigate and prevent for such risk.Such efforts are essential for brokers and venues in the finance manufacture, given the potential for fallout in the face up of unforeseen events or crises. Given a more tightly regulated environment across almost every asset class, nigh brokers employ a risk management section tasked with analyzing the data and flow of the banker to mitigate the firm'due south exposure to financial markets moves. Why Gamble Management is a Fixture Among BrokersTraditionally the company is employing a risk management squad that is monitoring the exposure of the brokerage and the performance of select clients which it deems risky for the business. Mutual financial risks also come in the form of high inflation, volatility across capital markets, recession, bankruptcy, and others.As a countermeasure to these issues, brokers have looked to minimize and control the exposure of investment to such risks.In the modern hybrid mode of functioning, brokers are sending out the flows from the virtually profitable clients to liquidity providers and internalize the flows from customers.This is deemed less risky and are probable to incur losses on their positions.This in plow assuasive the broker to increase its acquirement capture. Several software solutions exist to assist brokers to manage risk more than efficiently and every bit of 2018, nearly connectivity/span providers are integrating a risk-management module into their offerings. This aspect of running a brokerage is also one of the near crucial ones when it comes to employing the correct kind of talent. Read this Term and engineering science strategies. He holds a BA in Economic science Management and is now busy finishing his MBA in Finance.

Source: https://www.financemagnates.com/thought-leadership/binary-options/binary-options-guide-how-to-set-bollinger-bands/

Posted by: flemingpringdow.blogspot.com

0 Response to "using bollinger bands for binary options"

Post a Comment